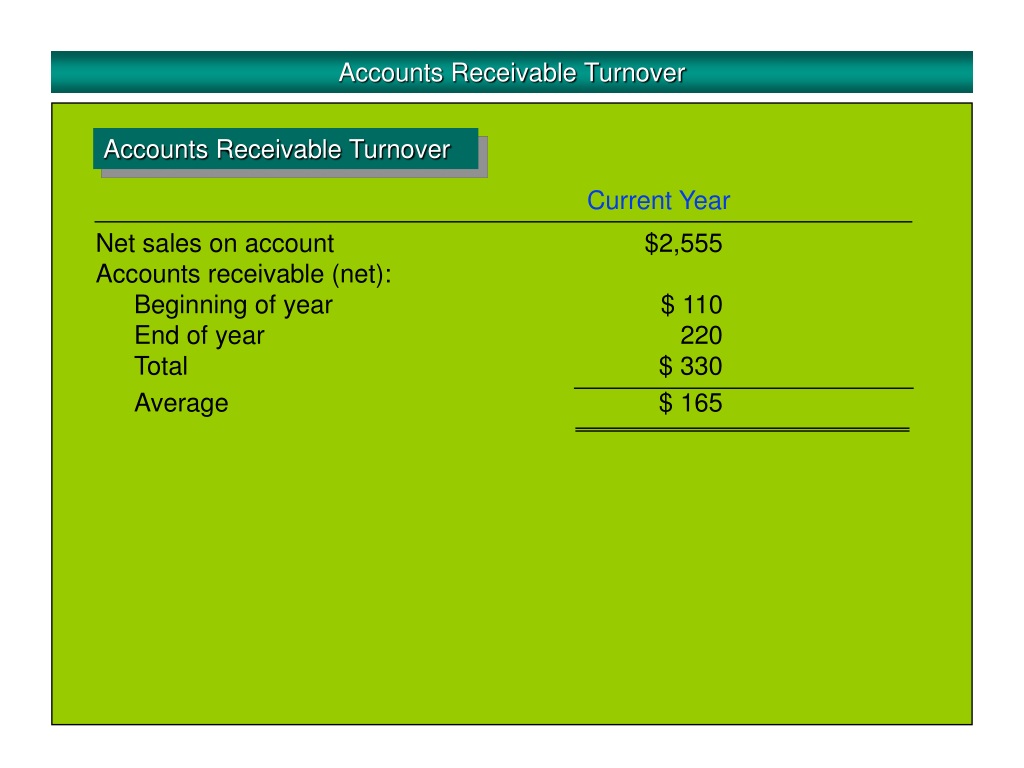

Receivables Turnover = (Receivables / Annual Sales) * 100.The formula for calculating this ratio is as follows: It tells you how much money is being collected from patients and insurance every year compared to the amount of sales made in one year. You can use the receivables turnover ratio to evaluate your business and determine whether it’s operating efficiently.

#Accounts receivable turnover measures how to

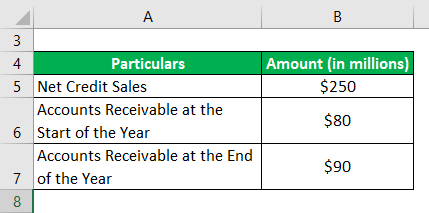

Divide the total charges, less credits received, by the total number of days in the selected period (e.g., 30 days, 90 days, 120 days, etc.) Learn How To Calculate It So You Can Evaluate Your Business! Subtract all credits received from the total number of charges. The formula for computing the accounts receivable turnover ratio is:Īdd all of the charges posted for a given period: 3 months, 6 months, 12 months. The Formula For Computing The Accounts Receivable Turnover Ratio Is:

The receivables turnover ratio is a measure of how many times per year a company can collect its average accounts receivable balance.Additionally, the lower the receivables turnover ratio, the longer a company may be extending credit to its customers without collecting payments and operating with cash flow issues. Generally, the higher the receivables turnover ratio, the more efficient and effective the firm is at collecting outstanding balances from clients and managing its line of credit process.It’s calculated by dividing net credit sales by the average accounts payable. The accounts receivable turnover ratio is a measure of how many times a company can collect its average balance due.The results are expressed as the amount of times a practice can collect its average accounts receivable throughout the year.It measures how efficiently a company can convert its credit into cashflow. The accounts receivable turnover ratio is an accounting measure used to quantify a practice’s effectiveness in collecting its receivables or money owed by patients / insuarnces.Divide the total charges, less credits received, by the total number of days in the selected period (e.g., 30 days, 90 days, 120 days, etc.)

Add all of the charges posted for a given period: 3 months, 6 months, 12 months.Additionally, the lower the receivables turnover ratio, Generally, the higher the receivables turnover ratio, the more efficient and effective the practice is at collecting outstanding balances from clients and managing its line of claims process.The results are expressed as the amount of times a company can collect its average accounts receivable throughout the year.It measures how efficiently a company can convert its cash flow. The accounts receivable turnover ratio is an accounting measure used to quantify a practice’s effectiveness in collecting its receivables or money owed by clients.

0 kommentar(er)

0 kommentar(er)